Paperboard industry driving rising usage of starches inside the EU

Starches are mainly extracted from wheat and corn and widely used in the manufacture of paper and board for its binding properties, from increasing the strength of paper, used as surface sizing but also used in the manufacture of corrugated paperboard, paper bags or boxes.

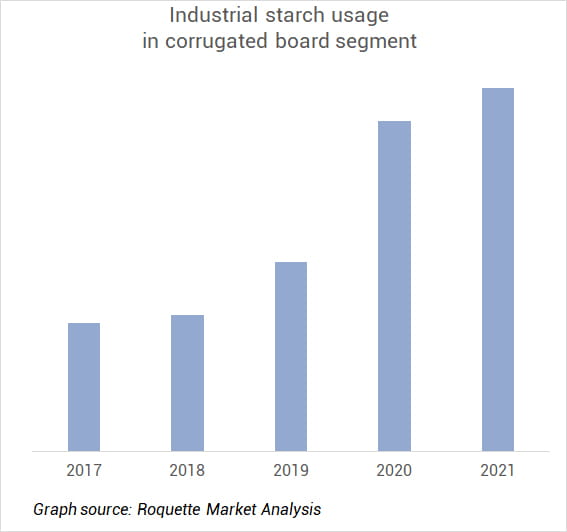

Demand for industrial starches is growing healthily despite the declining usage in graphic paper, following the booming e-commerce and “plastic-free” trends.

We assume that consumption of industrial starches in corrugated board segment registered a healthy annual growth of 3% for the past five years and rose by 6% last year as e-commerce was boosted by measures linked to the COVID-19 pandemic. Market demand is expected to continue growing steadily this year, but will supply capabilities follow?

EU starch supply and demand balance tightening

The industrial starch supply capabilities have increased in recent years to meet rising demand from the paperboard industry. However, two starch drying assets have been removed from the market recently, tightening the current supply and demand balance, and no additional significant drying capacities are expected to come on the market this year.

EU starch players are optimizing their assets to meet the additional demand, but tightness is expected to remain this year as total drying capacities are limited.

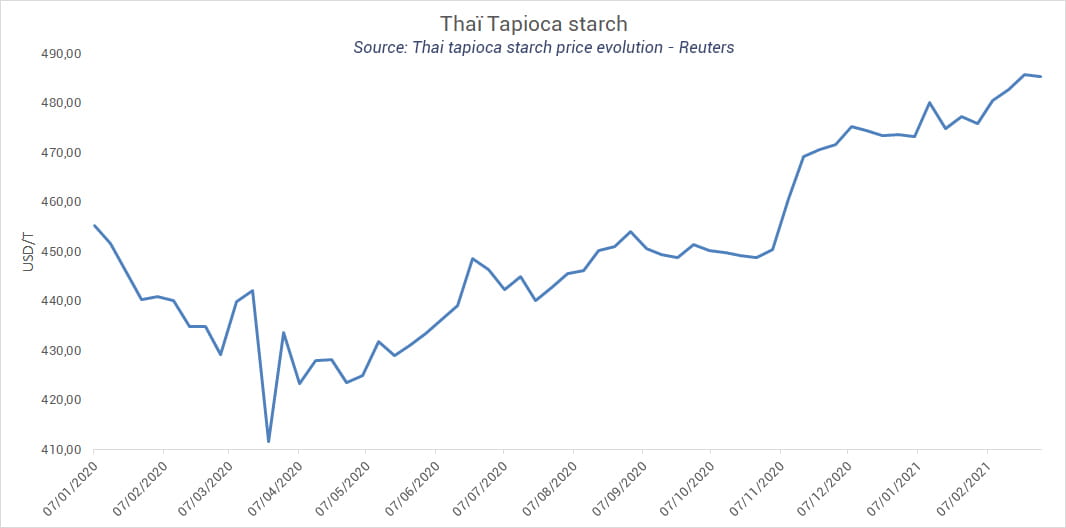

Imports of tapioca starch used as substitute for both EU corn and wheat starch may become difficult as the Asian starch market situation is very tight in a context of a surge in Chinese corn starch pricing. China is indeed a major supplier of corn starch to Asian countries. Exports are shrinking as the price of Chinese corn starch hits historically high levels, leaving an important volume of starch demand being supplied by other origins and botanicals like tapioca starch which is the most available native in the Asian market. Furthermore, rising freight cost and transport disruptions of tapioca starch are making supply to EU market more difficult.

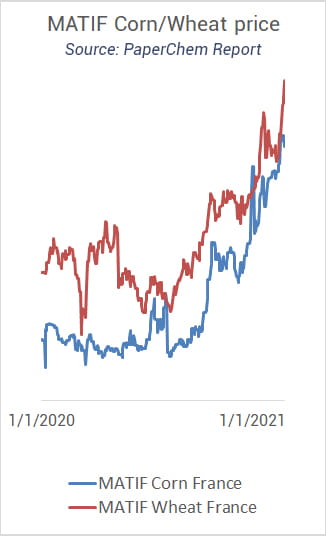

Challenging rising cost for the starch industry

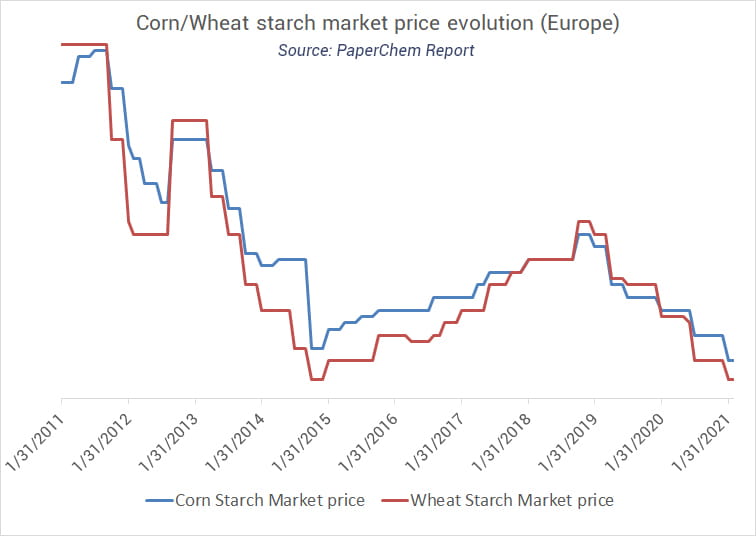

The starch industry is facing the challenge of historically high raw material costs; therefore, sustainability of industrial starch profitability is becoming questionable in the current market environment as the market reports a wheat/corn starch price in paperboard segment hitting 10 years’ bottom in Europe, while the market of industrial modified starches remains rather stable.

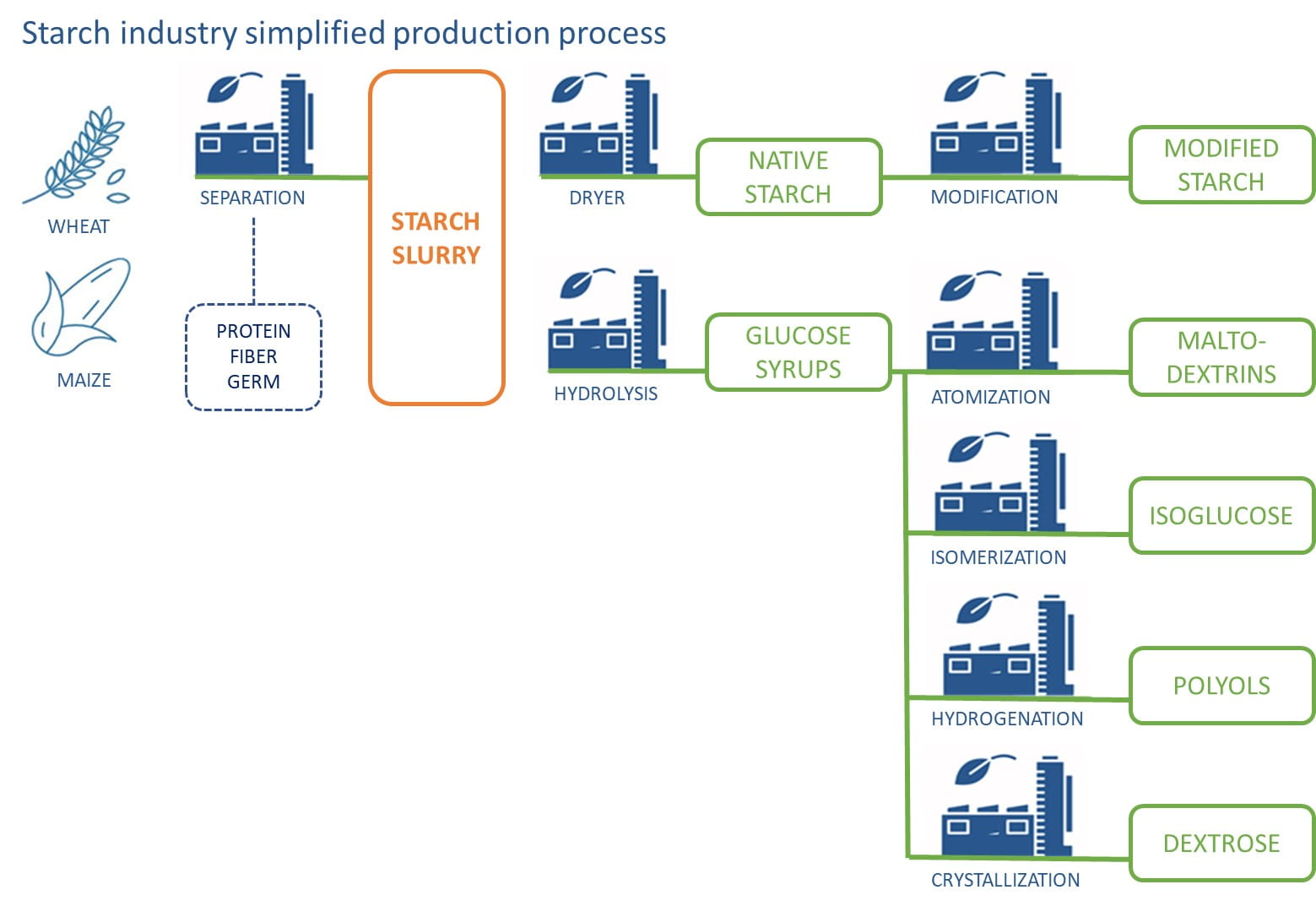

The starch industry does have the ability to produce a wide range of starch derivatives out of the starch slurry extracted from wheat and corn. In the current challenging environment, starch manufacturers must find the right balance in the process of their starch slurry to produce a range of starch derivatives that both meets market demand and covers cost increase to remain competitive. This may limit even further the supply availability of some industrial starches in Europe.

Securing industrial starch supply in Europe

Roquette is a market leader provider of cost efficient industrial starch solutions for the paperboard industry in Europe, offering an extended portfolio and high technical expertise.

Discover Roquette extended portfolio of cost efficient industrial starches.

Also published in Packaging Europe